Ready to jump into the world of business credit? There are all the best high-limit business credit cards you have to look at when taking your business’s finances in consideration.

Opening a business credit card is not a light matter. It is an important decision, and many factors must be considered to ensure you are setting yourself up for success. As a business owner myself, I am giving you a detailed breakdown of the top high-limit business credit cards to consider.

You will learn about all the ins and outs of high-limit and no-limit business credit cards.

After reading and learning about all the credit cards you will be in a much better position to make a decision on which card works best for you.

This blog post will discuss the top high-limit business credit cards for your business’s financial requirements.

Disclaimer: This blog is for informational purposes only and does not offer financial or legal advice. Consult a licensed professional before making financial decisions. Opinions are personal and may not reflect the latest terms from institutions.

Best High-Limit Business Credit Cards in 2024

Consider a few critical factors when choosing the best high-limit credit card for your business. These factors significantly affect how a card might align with your business’s financial needs. Here are the factors I am focusing on for this blog.

Credit Limit

Considering the title of this blog, the most important thing I considered when determining which cards made the cut was the potential for high credit limits.

While many factors affect your credit limit, all the cards below generally have relatively high credit limits (especially compared to the limits you would get with their counterparts).

Reward Program & Benefits

Many of these high-limit business credit cards’ main benefit is their rewards/points program. When comparing the rewards, I examined the welcome bonus and the points incurred during spending.

One thing I think is undervalued in the other comparisons I found online is customer service. This is critical when you are relying on a credit vendor for your business’s financial needs.

Annual Fees & Costs

Precisely how these costs stack up against the value of the benefits you get.

The biggest difference between the high-end cards we will be exploring below and their counterparts is that these tend to be pay-to-play, which I am a big proponent of as long as the value is well worth the cost.

Who a Card is For and Who it isn’t For

Many of these card’s benefits are typically geared towards one type of spending. While most people will get some value from these cards, the main difference between how much value your business needs and how well they align with the card’s benefits

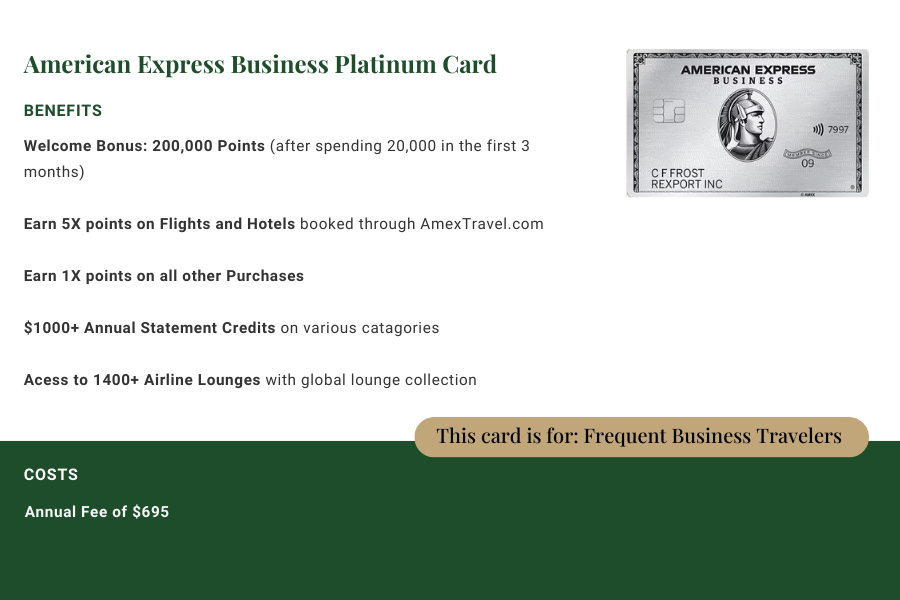

American Express Business Platinum Card

American Express cards aren’t standard credit cards but charge cards. While they operate very similarly, they have two main differences.

- Charge cards require full payment of the balance each month.

- There is no set credit limit.

American Express goes into detail about the differences on its website.

Credit Limit

As mentioned above, Amex does not utilize traditional credit limits. Instead, as per the American Express website, “charges are approved based on your spending pattern, financials, credit record, and your account history.”

This means that your credit limit changes based on your financial situation. While this can be tricky, it stands out because it can adapt quickly to your business’s changing financial needs. That being said, the credit limit tends to be higher than most cards on the market.

Rewards & Benefits

The benefits of this card are overwhelming; here are the more important ones.

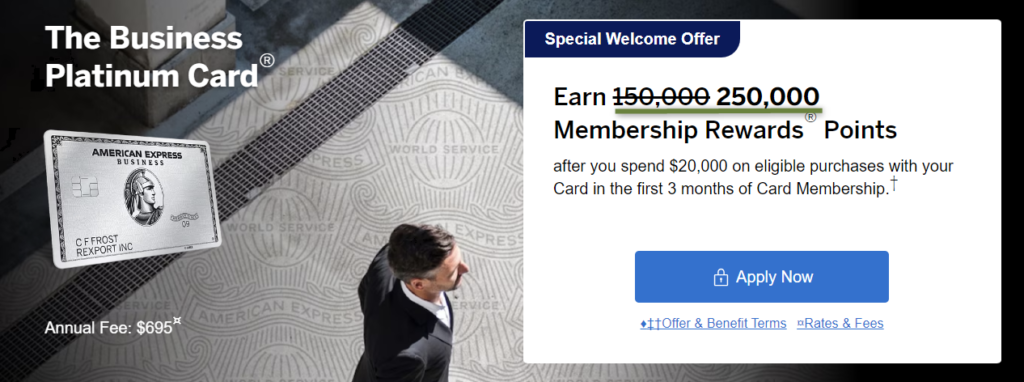

Welcome Bonus

The welcome bonus is elevated to 250,000 points once you spend 20,000 dollars in the first three months, valued at approximately $2500.

Just a reminder: the value of your points can change significantly depending on how you redeem them. For example, I recently used 70,000 American Express points to book a $1500 flight to Switzerland to visit my in-laws. These points were valued at 2 cents each, or 4000 for the welcome bonus, instead of the regular 2,500.

Spending Bonuses

5x points on Flights & Prepaid booked on Amextravel.com

- 5x points on Flights & Prepaid Hotels booked on AmexTravel.com

- 1.5x points on eligible Business expenses (Electronics, Materials, Hardware, Shipping, and all purchases over $5000

- 1x points on all other spending

Other Benefits

Here is a quick summary of their other notable benefits:

- $1400+ in Credits on select Spending

- $400 Dell Technologies Credit

- $360 Indeed Credit

- $150 Adobe Credit

- $120 Wireless Telephone Credit

- $200 Airline Fee Credit

- $199 Clear Plus Credit

- The Global Lounge Collection: Access to 1400+ Airport Lounges

I won’t cover other benefits, such as lounge access and pay-over-time features, as they are standard for all cards on this list.

Customer Service

Amex has a reputation for superb customer service, and it follows through. Once you get someone on the phone, it is such a seamless experience.

The one thing is I wish they had email support as well. Sometimes, I don’t want to wait 20/30 minutes for a customer service representative to become available. Especially in matters that aren’t urgent; I would rather send an email and forget about it until someone has time to take a look at it.

Also, with the platinum card, you get access to the concierge service, and while I don’t use it as much as I hoped I would, it is such a pleasant experience when I do.

While Amex does outsource its customer service, it doesn’t feel like a second thought as it does to a lot of other companies nowadays.

Annual Fees & Costs

This card has an annual fee $695…this section is easy

Who do I think this credit card is for

This credit card is mainly for Frequent Business Travelers.

Most of the point’s structure and benefits are geared towards traveling.

Who do I think this credit card is NOT for

If you are involved in a business that has very, very, very minimal travel needs, you should consider this plan. While many non-travel-related credits can help cover the annual fee, a lot of the point structure and benefits revolve around travel.

One thing to watch out for with this card: Once you get the welcome bonus for the platinum card, you won’t be eligible for the welcome bonus for the gold card. On the other hand, if you get the Amex gold and then the Amex platinum, you will receive both bonuses.

See more details on AmericanExpress.com’s card details page.

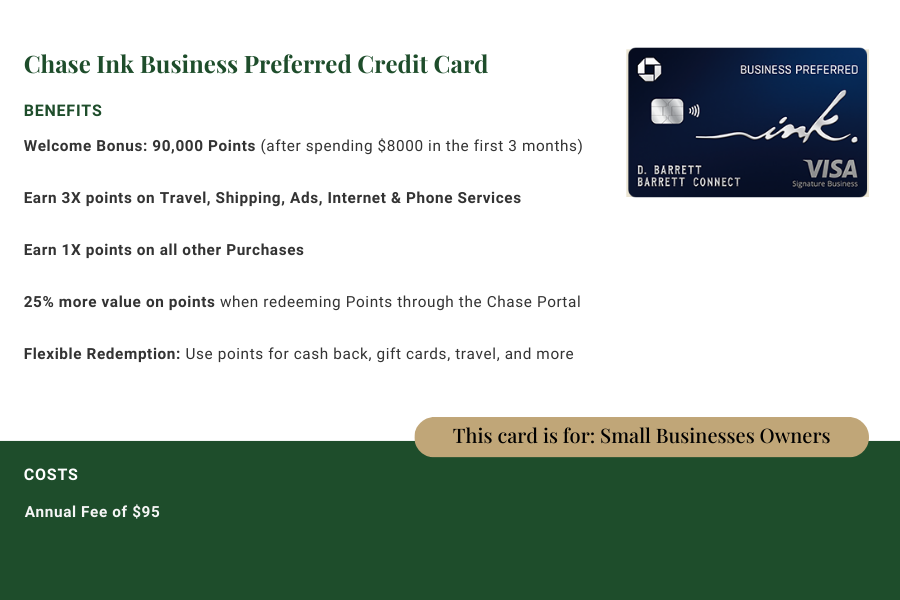

Chase Ink Business Preferred Credit Card

If you haven’t noticed, I didn’t recommend Chase’s top-of-the-line credit card, the Chase Ink Business Premier. Crazy, I know.

Here is the thing with Chase: they do the basics really well, which is great. The only issue is that they do them so well that it doesn’t make much sense to upgrade to the next tier of cards.

It makes it the perfect low maintanance high credit business credit card

Credit Limit

The starting credit limit for this ranges from $,5000 to $25,000. The interesting thing here is that the top-end number also matches the top-end number of their highest-level premium card.

While it doesn’t have the same potential as the AMEX platinum, the credit limit for this card isn’t something to scoff at.

Rewards & Benefits

Again, the simple things really really well.

Welcome Bonus

90,000 points after you spend $8000 in the first 3 months after account opening. For comparison, this is worth around $900 or $1,125 when redeemed through Chase Travel.

Spending Bonuses

- 3X points on the first $150,000 points spent in the follow catagories:

- Shipping

- Ads

- Internet, Cable and Phone plans

- Travel

- 5X of lyft

Other Benefits

- 25% more in travel redemption

- Employee cards at no additional cost

Customer Service

I have interacted with Chase customer service numerous times; even though it is ranked at 1.3 on CustomerAffairs.com, I have had average experiences with its representatives.

Nothing extraordinary, nothing terrible, just standard customer service. I might be bias though because I love that they have the option to address issues over emails.

Annual Fees & Costs

This card has an annual fee of only $95 a year, which is why it is on this list. It’s not the best card on here, but the value per cost; it wins every time.

Who do I think this credit card is for

This card is for small business owners who are dipping into the world of high credit limit credit cards. It doesn’t have everything the other cards do, but it has the basics covered at a low cost.

Also, with the lower spending requirements to earn the welcome bonus, it is perfect for businesses not spending $10,000+ a month (I wish)

Who do I think this credit card is NOT for

While this card has some travel benefits, I would say if you are a frequent traveler, look elsewhere.

Also, for people who have been using these types of credit cards for years, it can be a little underwhelming.

You can see more details on Chase’s card details page.

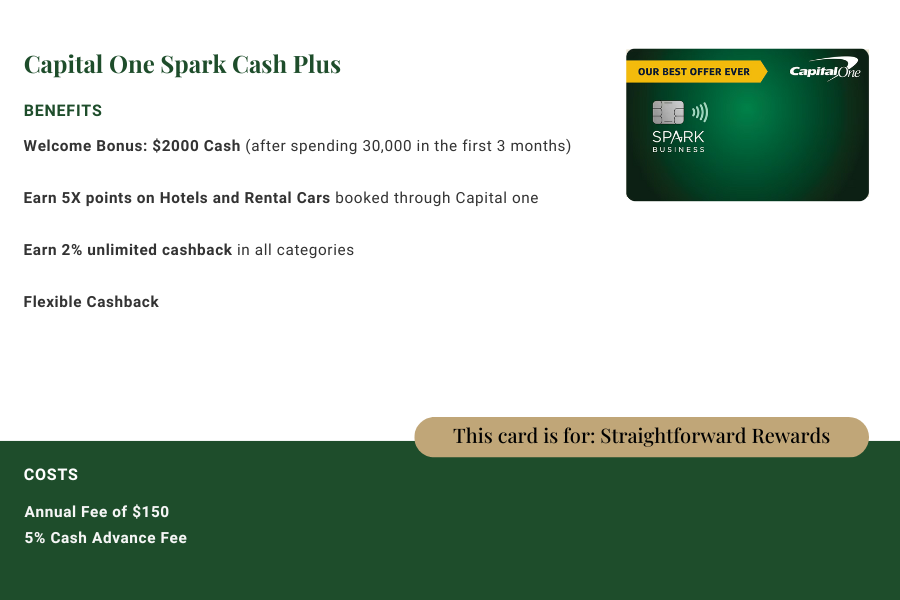

Capital One Spark Cash Plus

Honestly, this used to be my favorite card for most business owners. Unfortunately, due to a recent few customer service experiences, I have been questioning its status at the top of the list.

So I figured I would be petty and put it last but not enough to downplay its awesomeness.

Credit Limit

Once again, this is a charge card with no current spending limit. This means that, like the AMEX, depending on your spending history and habits, the sky is the limit.

Rewards & Benefits

Welcome Bonus

Cold hard cash, you get $2000 dollars when you spend $30,000 in the first 3 months.

Spending Bonuses

THIS IS THE REASON I LOVE THIS CARD…2% back on everything, all of it.

Most cards give you 3-5X on select categories, and everything else is at a standard 1X, but with the capital one card, you essentially get 2% back on everything. It makes it the perfect catch-all cost.

This isn’t an Ad, I swear.

There is also an unlimited 5% back on all hotels and rentals booked with Capitalone.

Other Benefits

Do you really need other benefits…did you not see the…okay fine…so it doesn’t really have any other benefits that are unique to the card…so what

Customer Service

This is the part that sucks, I rarely need to talk to their customer service, but when I do, it is always an unpleasant experience.

Capital One outsources its customer service to the Philippines, which isn’t an issue in itself. However, every time I am on the phone with them, I can tell that they have minimal ability to do anything or any general knowledge of how their products work.

I spoke with a customer representative who suggested that the reason my virtual card isn’t working is that I am copy-pasting it incorrectly. She genuinely had no other advice other than “recheck the number,” which I copied-pasted through their app. When they finally regenerated my other number…magically copy, paste started working.

Annual Fees & Costs

This card has a $150 a year Fee

Who do I think this credit card is for

This Card is perfect for anyone who just wants to use one straightforward card on everything and not worry about which card to use for what.

It’s simple, straightforward and and beautiful…shhhhh

Who do I think this credit card is NOT for

Since this is a Cashback reward system, this card is not for someone always trying to optimize their points for the most value. If that sounds like you and you are as excited as I am about the 2X, check out the Venture x card for business.

You can see more details on Captial One’s card details page.

Runner Ups & Honorable Mentions – Generic picture of the cards

We won’t go into as much detail for these cards as we did with the ones above. However, they are worth mentioning.

Capital One Venture X Business

Same 2X back on all purchases, but has additional benefits as well as is points based instead of cashback.

It’s my favorite personal card because I don’t have to overthink utility.

Chase Ink Business Premier Credit Card

This is the highest card in the Chase Ink Business card line. I excluded it from the list above because it is very similar to the Capital One card (2X back on everything), but the welcome bonus is half as much with a higher annual fee.

American Express Business Gold Card

American Express Platinum’s younger brother, a great entry into the AMEX family.

I also think everyone who is aiming to get the platinum card should get this one first to benefit from both welcome bonuses (if you get the platinum first, you are no longer eligible for the gold bonus)

No Comment! Be the first one.