Are you curious about Buying into a Business as a Partner? It can be a very lucrative investment; let me tell you why you should consider it, what to look for, and how to go about it.

Buying into a business as a partner can be highly complex and lengthy; like me, you are probably doing all the research possible to ensure you take the proper steps moving forward.

As someone looking to take the next step in buying a business, I am sharing the best information from all my research, which I swear by and am currently using to close my first deal.

This blog post will cover everything someone interested in buying into a business as a partner needs to know to execute successfully.

Disclaimer: This blog is for informational purposes only and does not offer financial or legal advice. Consult a licensed professional before making financial decisions. Opinions are personal and may not reflect the latest terms from institutions.

Why Buy Into a Business

Instant Return on Investment

According to Morgan & Westfield, the value of an average small business is at 2-4 times a seller’s earnings (SDE).

Let’s Break that down further: If I own a business that generates $100,000 in cash flow, I might sell it for $200,000 to $400,000.

If you were to buy the business, you would instantly be in a position where your investment return is 25-50 percent ($100,000 in cash flow each year on a $200,000 investment is 50% ROI). But then you are stuck running the business you now own.

The same ROI applies to parts of businesses as well. Depending on your agreement, you get an instant return on investment, but you also get to choose your involvement, from a silent investor to a full-time operator.

Established Foundation

Almost half of businesses fail within five years. That number jumps to 65% if the business span is ten years. It’s much harder to start a business from zero and scale up to $100,000 than to Invest in something already making $100,000 consistently.

While all businesses have risks, being involved in an already established business reduces that investment risk.

Shared Risk

Speaking of Risk, owning a part of the system means you own a part of the risk, ideally with an industry expert who grew the business to where it was before your involvement.

Owning parts of different businesses in different industries also reduces risk through diversification. For instance, in 2020, most restaurants struggled while grocery stores did well.

Owning 100% of a restaurant puts you in a much worse place than owning 25% of a restaurant and 25% of a grocery store.

Strategic Collaboration

Buying into a business enables you to bring strengths and insights that complement the business. This leads to better decision-making in those areas and a different point of view when discussing a problem.

It also allows you to benefit from someone else’s expertise and experience, which can help expose you to different networks and markets.

Buying into a business can also make sense for you if there is natural scenery between your industry and theirs. For instance, a successful coffee shop owner might buy into an up-and-coming bakery.

How To Find Businesses To Buy Into as a Partner

Online Platforms

Plenty of websites exist to help connect business buyers and sellers. While many are aimed at whole-business buys and sells, some are focused on partial business transactions.

Unfortunately, for most of them, you have to be an accredited investor to invest directly with the platform. Also, many of them are walled off by brokers just looking for their commission.

While I don’t mind a broker, I like speaking to business owners directly, especially when I intend to work with them rather than buy something from them.

These sites are great for initial research and getting a feel for the market and the industry you are interested in.

Websites for Partial Businesses

Websites for Whole Businesses

Business Brokers

Working with a Business Broker when looking to invest in a business can be a game changer, especially if this isn’t a one-time thing.

That being said, it will cost you around 10%. Ouch. Split across you and the seller that is around 5% extra. But you do get what you pay for. Here are a few reasons it may be worth it for you

- Access to deals not available to the general public.

- Access to Expertise

- Streamlined Process

- More Accurate Valuations

- Confidentiality

- General Guidance

In general, business brokers have done and seen many of these deals; while you may be an expert in your industry, a good broker is an expert in executing the agreement.

Personal Network & Community

Looking into your network and local community can often be an excellent resource for finding deals you wouldn’t be able to see otherwise.

Start by contacting friends and family and letting them know about your interest in investing. They might know someone looking for a new partner or investor. Also, ask colleagues in your field for more niched-down options specific to you.

Industry-Specific Conferences and Events

In addition to your networks, ensure you are taking advantage of industry-specific conferences and events. These are great ways to meet industry-specific business representatives and find the right business partner.

For small businesses, this also eliminates the middleman of a business broker or website where you have to pay to send a message. In the worst-case scenario, you grow your network within your industry for future opportunities.

What To Look For When Buying a Business as a Partner

You can easily obtain much of the information below through the current owner; just don’t be surprised if NDAs are mentioned.

Verify the information as best you can, but always require the seller to put anything in writing and warrant every essential part of the transaction.

Check out this Due Diligence Checklist from Score.org

Financial Health

This is the main thing anyone looking to buy into a business looks at. When buying a business outright, a company’s financials are its potential; however, when buying into a business, the finances accurately represent the business’s finances under the leadership of current management, who you intend to partner with.

Here are the main four things I look for:

1. Cash Flow Statements

The ideal business would have consistently positive cash flow statements, which prove that the business’s financials are appropriately managed. I look at this instead of profits because a company can profit with lousy cash flow.

2. Liquidity Ratio

While there are many different types and calculations, a simple version of this is a company’s assets divided by its liabilities.

A Liquidity Ratio over 1 shows that a company has more assets than liabilities and is usually a good indicator of its ability to cover its short-term obligations.

Look at Corporate Finance Insitutes’s Artice for a deep look into Liquidity Ratios.

3. Debt to Equity Ratio

This Ratio represents the amount of debt a business has regarding its equity (Equity = Total Assets—Total Liabilities). While you may think you should only buy businesses with no debt, that is not always realistic. Depending on the industry, my main focus is that the Ratio makes sense for the debt type.

For instance, a business with a debt ratio of 3 because it has a long-term loan for property development may have a good ratio. On the other hand, a supermarket may only have a debt ratio of .5 because of unsold inventory and low cash flow.

In this case, I would consider a business with a 3 debt ratio much healthier than the .5 one. It’s essential to consider the context when evaluating Debt Ratios.

4. Return to Equity Ratio

This Ratio measures how much income shareholders of the business realize. It indicates how effective a company is at generating profits.

Honestly, it needs to be a minimum of 15%; while that may be aggressive in some industries, my honest thought is that the stock market is right there. The SP500 averages around 10-11% returns with much, much less risk and effort.

Company Culture and Values

This is just about ensuring the company culture and values align with yours. You can always sense a company from its policies and employee conversations.

Only a positive company culture is sustainable over the long term, and as an investor, I only really care about the long term.

Legal and Liability Issues

Unfortunately, all liabilities are financial. Buying into a business means buying into its past; make sure there are no skeletons in that closer. Here are a few things to look at.

- Intellectual property rights

- Regulatory compliance

- Pending lawsuits or legal disputes

- Insurance coverage and liability protections

- Contractual obligations with customers, suppliers, or partners

Exit Strategies

These differences are so different from business to business that I won’t go into too much detail here, but here is the US Chamber of Commerce’s guide on creating an exit strategy.

Whatever works for you, make sure they are discussed and well-defined. It’s always easier to get this done in the beginning when all is good than later.

Other Specific Factors

There are a few other factors to always look at outside the main ones above.

Customer Activity

The main factors are the average number of new customers a month and customer retention. A business that balances those two factors well will do much better than those that don’t.

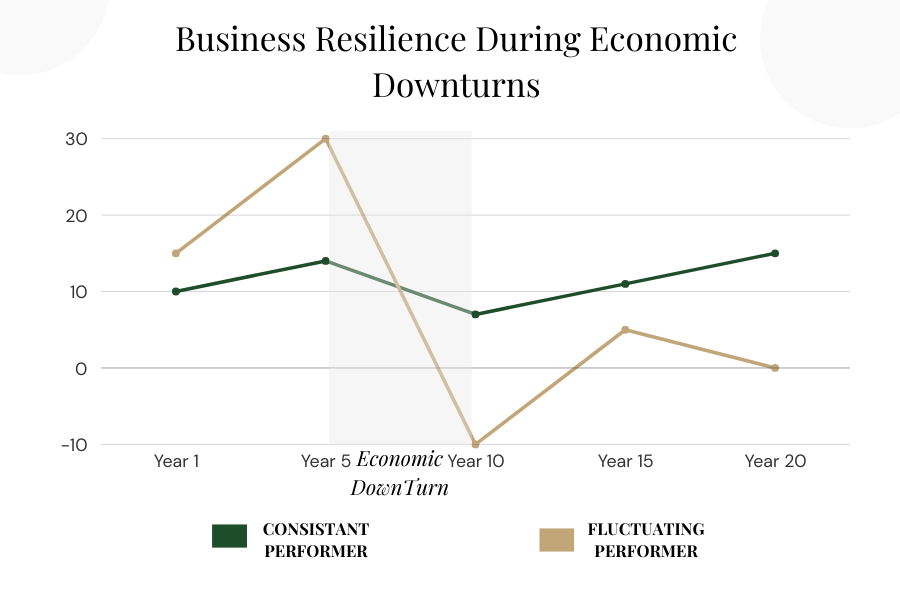

Downturn Behavior

Look into how business metrics were affected by a general economic downturn. My favorite types of business are the more consistent ones, regardless of external factors.

They may not do as well as other businesses at times, but consistently consistent can always be counted on.

General Dependencies and Vulnerabilities

While we cannot cover everything for every business, here are a few other things to consider.

- Key Personnel Risk

- Supplier and Vendor Dependencies

- Customer Concentration

Financing Options

Here are the most common ways to finance your investment.

Traditional Bank Loan

This is when you borrow money from the bank and are repaid over time with interest. It usually requires a down payment of 10 to 30%.

The advantages of these loans are that they are very predictable in repayment and terms. For instance, banks usually don’t take ownership of the business.

The disadvantage is that these are extremely difficult to qualify for; for people just investing in businesses, your chances of getting approval are meager.

SBA Loan

The most common form of financing for small businesses is a loan from a small business association. These loans are offered from the same lenders as traditional bank loans but are backed by the government, reducing the lender’s risk.

These loans typically require a 10% downpayment and longer repayment terms, making them perfect for most beginners.

Getting an SBA loan is a long and challenging process, with approval rates around 50%. However, they are more beginner-friendly than traditional bank loans since the lender takes less risk.

Seller Financing

This is when you finance the purchase with the seller. You would pay the seller a portion of the sale price over time, like a bank loan, but with the seller. This allows you to pay the seller with revenue from the business.

Seller financing is much more flexible, with negotiable terms and conditions. It also offers many benefits for sellers through tax cuts.

This is rare when buying into a business as a partner because most businesses looking for investors want cash or experience.

Crowdfunding

This is when you raise a small amount of capital from many people, adding up the amount you need.

While these are great if you have no financial assets, you are trading that for time and effort. You also tie yourself to other people’s fulfillment agreements.

Also, a successful crowdfunding campaign usually requires hefty marketing to kick off, which costs money. It’s a catch-22. While it has its uses, I recommend most beginners avoid crowdfunding.

How to Buy Into a Business as a Partner

Now that I have finished boring you with all the details let’s get into the how. Below is a simplified step-by-step on how to buy into a business as a partner.

Make sure to follow best industry practices and research; each business is different.

Perform Due Diligence

Go deep. This is a serious decision, so do not skip any steps. This can be a whole blog post by itself, but for now, here is a due diligence checklist from FindLaw that I have found to be a great resource.

My wife has this saying that fits well here: Trust but verify. Make sure everything is audited and reviewed by professionals in that field, such as accountants and lawyers.

Negotiate Terms

Always aim to secure terms that best fit your financial goals and operational plans. Here are the most important things to discuss.

- Purchase Price

- Financing Option

- Down Payment Amount

- Transitional Period

- Business property rights

- Contingencies

There is much more to this, but discuss everything that matters now; if you can’t agree, then none of the following steps matter.

Secure Financing

Whatever financing you choose, ensure you follow the procedure to secure the investment. Here are some comprehensive guides on all the forms we discussed earlier today.

I left out crowdfunding since it’s much rarer when buying into a business.

Plan Your Future

Now that that’s over, it’s essential to discuss your future plans with your prospective partner. This ensures you both have the same idea of the future.

While you don’t need to iron out every detail, focus on the significant points—growth goals, exit strategies, and long-term commitments. Also, talk about the level of involvement you expect over time. Are you both planning to stay hands-on or is one of you looking to transition to a more passive role?

Getting on the same page on these aspects this early can help prevent misunderstandings and ensure a smoother partnership.

Partnership Agreement

A partnership agreement is crucial for establishing clear roles, responsibilities, and expectations.

This should outline ownership percentages, profit-sharing, decision-making processes, and each partner’s contribution. It should also cover exit strategies, dispute resolution methods, and steps for adding or removing partners. Doing this will protect yourself and your partner, ensuring a solid foundation for a successful partnership.

No Comment! Be the first one.