Want to know the Active Income and Passive Income Examples that helped me understand the different types of income and their impact on my finances?

The first step in almost anything in life is figuring out where you stand and where you want to be. Analyzing your income streams is no different.

Most people know the essential “passive income good” and “active income bad” for wealth generation. But how many people know the nuances and how to differentiate? I didn’t when I started on this journey.

After learning all about Active and passive income and reviewing the examples, you will be a pro when analyzing your income streams now and your goals for the future.

This blog post is all about breaking down active and passive income and active income and passive income examples that everyone on the road to financial freedom should know about.

Disclaimer: This blog is for informational purposes only and does not offer financial or legal advice. Consult a licensed professional before making financial decisions. Opinions are personal and may not reflect the latest terms from institutions.

What is Active Income

The easiest way to think about active income is money earned through direct involvement, essentially anything where the money you earn is and always will be directly proportional to the time or effort you put in.

Active income is significant for everyone; whatever your financial goals are, a good active income sets a foundation for all your other ventures.

Active Income in 2024

When they think of this, most people go straight to the salary most Americans make from their full-time jobs. While that is still true, with the recent increase in technology’s involvement in how we work through remote/hybrid models, the definition of active income has expanded to more commonly include things like gig work, freelancing, or digital-based contracting positions.

As inflation and the cost of living rise, active income helps many Americans with their financial responsibilities every month. While things have changed in the last decade, active income still typically represents safe, consistent, and straightforward income.

That being said, active income typically also represents the most time-consuming form of income and lacks the wealth-building potential of other forms of income.

In 2024, having multiple income streams became a more popular trend, with 50% of people having a side hustle. And who can blame us? I spend too much money on groceries nowadays.

Tax Implications

Active income is typically subject to the full range of tax obligations, and there are few ways to reduce them.

I mean, have you looked at all the taxes lately? It’s not looking good, folks.

- Federal Income Tax

- State Income Tax

- Federal Insurance Contribution Act – Who even is FICA?

- Self-Employment Tax

- Capital Gains Tax

While some things can be done to lower your active income taxes, they are constrained, typically including writing off student loan interest or limited freelance expenses.

I have always found that weird. Why can’t we write off student loans? They are an investment made that, for most, is directly related to…ahh, don’t get me started on student loans.

What is Passive Income

Passive income refers to any stream of income that doesn’t require your direct involvement to bring in income.

Most of the time, active work is required to convert into passive income. This is mainly when you start trading the value of an asset, service, or product for money instead of your time.

There are many examples below, but a quick one is rental income. A landlord trades their property’s value for money. Once you have a tenant and a management company, your money isn’t dependent on your time.

Passive Income in 2024

While Passive income has always been one of the main pillars of financial freedom, the landscape of passive income has changed more than ever.

Traditionally, passive income has been about leveraging the pre-existing value of an asset to generate money passively, such as renting a home.

In 2024, passive income has become all about leveraging technology and digital platforms for scalability.

While investments in stocks and real estate are still popular, content creators and educators can mobilize digital products, like courses and content, to make money passively through digital sales and affiliate marketing.

Tax Implications

Passive income has many advantages, especially compared to active income. Here are the main things to consider.

- Capital gain tax

- Dividend Tax:

- Rental Income Tax

- Self-employment Tax

While it seems similar to active income, the main difference is the options you can use to meditate on it that aren’t available for active income.

Here is a quick list:

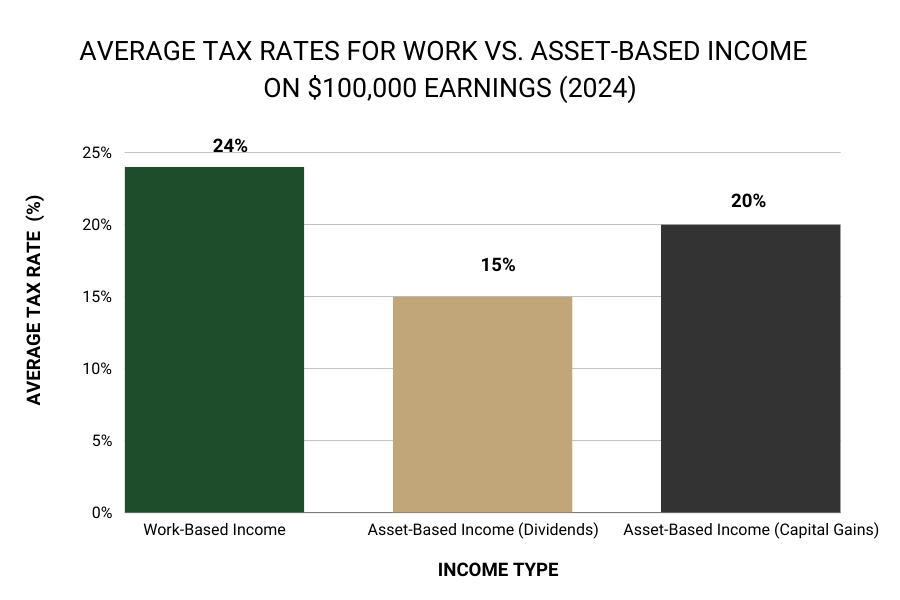

- Capital Gains Tax: Lower tax rate on long-term investments than active income.

- Depreciation: Write off asset depreciation over time to reduce taxes.

- Rental Property Expenses: Write off mortgage interest, maintenance, and other rental property expenses.

- Passive Loss Deduction: Offset passive income with losses from other passive income streams.

- 1031 exchange: Defer capital gain taxes by reinvesting your profits.

The graph above shows how different your taxes can be. Mind you, it doesn’t include state tax or all the other things you get docked for in active income streams.

Now that you know the main differences, it’s time to examine the active income and passive income examples in depth.

17 Active and Passive Income Examples

7 Passive Income Examples

Creating an Online Course

Creating an online class is a great way to leverage your expertise in a topic to create a passive income stream. If you are interested enough to learn, someone else is too.

This classifies as passive income because even though it takes active work to create the course, once you do and have a marketing strategy in place, the amount of money you make is no longer tied directly to your time or effort.

It doesn’t matter what topic you pick as long as you are knowledgeable and passionate about it.

RealEstate CrowdFunding

Real estate crowdfunding occurs when people or investors pool their money to invest in real estate.

Companies like Fundrise do this process online. You can start with as little as $10; companies like Fundrise take that money and invest it in real estate projects, then give you the returns on investment with no effort on your part.

Affiliate Marketing

Affiliate Marketing is when you make a deal with a product or service provider to sell their product or service in exchange for a sale cut.

In 2024, the most popular way to do this is to create promotional content around a product to draw attention to the product and hopefully convert sales. That’s how many TikTok reviewers you see are making their money.

Once again, this is considered passive because when you create the content and implement a marketing strategy, the money you make is no longer tied to your time.

Blog and Content Creation

This one is tough for me to include; as a blogger, this doesn’t feel passive. That said, the money I made (all 10 cents this month) from previous blog posts.

As you grow an audience that cares as deeply as you do about your niche, each previous piece of content that generates income is technically passively generating income.

The main issue with this passive income stream is that it takes a lot…I mean a lot of early work for virtually no income. But what can I say? I am a sucker for punishment.

Jokes aside, I love blogging about the topics I am obsessed with. It has helped me evolve financially and personally.

While I haven’t experienced much on this side of things, blogging and content creation to build an audience will also help you immensely when exploring other income streams.

High Yield Saving Accounts

Passive income doesn’t have to be as complicated as all those tiktok financial advisors make it seem. High-yield savings accounts are a great way to start with passive income.

You pick an account, open it, transfer money, and you are done. At the time of this article, the average percent yield on a savings account is 5%.

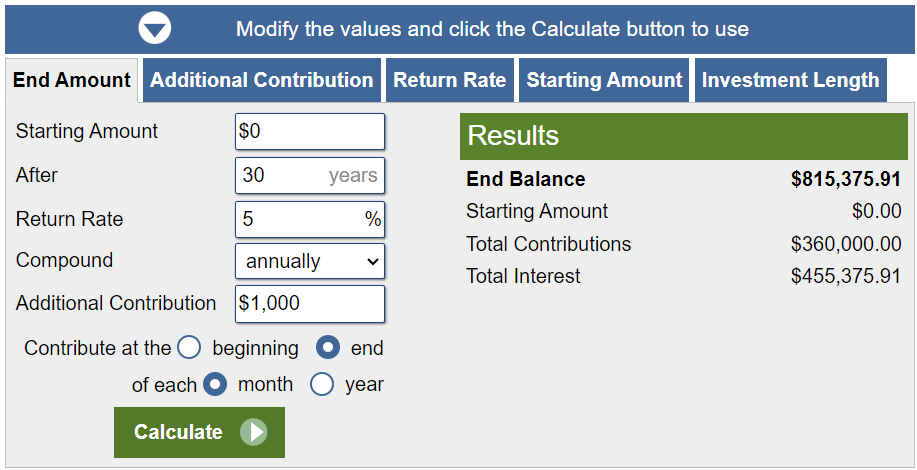

The image above shows that if you invest $1000 a month for the next 30 years or $360,000 in total, you will make $455,379.91 passively. While this is not the best use of your money (you can get a higher rate through index funds and real estate crowdfunding), it’s a great way to start with minimal risk.

Check out the calculator here to run your numbers.

Rental Income

Whether you buy a rental property or rent an extra room on Airbnb, rental income is a great way to make passive money if you have the resources to invest in a property (I wish).

While some work involves finding tenants and maintaining equipment, most of your income isn’t based on your time.

Dividend Paying Stocks

Established companies sometimes pay their shareholders a percentage of the profits. They usually do this to illustrate that they are doing well enough to return their shareholders’ money. It also increases the demand for their stock, increasing cost per share and the whole company evaluation.

The good news is that anyone can do it for many of the biggest companies that offer this. All you have to do is pay a share of their stock. Then, you sit back and either collect the money or reinvest it.

Dividend yields typically range from 2-5%, not counting the company’s growth.

Check out 7 Simple Passive Income Streams for Beginners for a deep dive into these examples of passive income and how to get started.

10 Examples of Active Income

Full-Time Employment

This one is obvious: in most cases, you clock in and out, trading your time and effort for money directly.

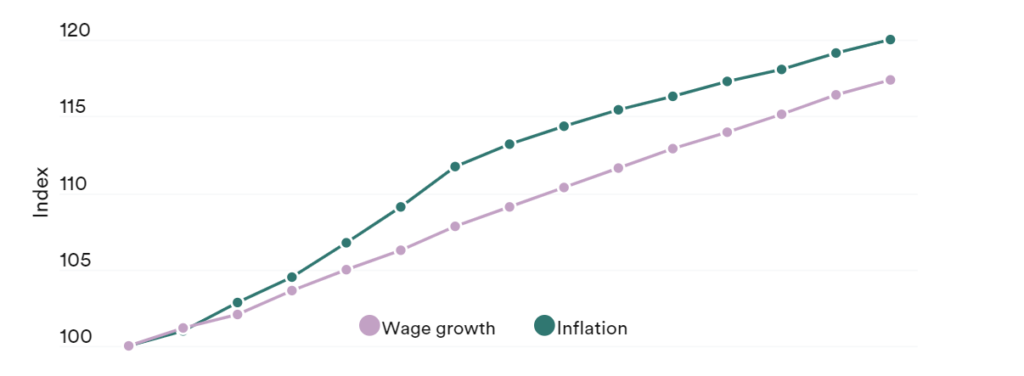

The general trend, especially in 2024, shows a decrease in full-time jobs. This is mainly due to low wage growth while inflation has been high.

The yearly take-home salary after taxes in New York is $56,206, while the average annual rent for a one-bedroom apartment is $46,404. This leaves just $9,802 for everything else, which is crazy considering the cost of living!

While New York may be an extreme example, other places aren’t that better off. At the end of the day, for most Americans, the math ain’t mathing.

That said, this is one of the most important sources of income since almost everyone starts their financial journey here. Whatever your goals, building a strong salary income is a strong foundation for all your other ventures.

Fortunately, I love my job, but it took a long time to get here. It’s also the safest and most consistent form of income for most people.

Freelance

This is a great way to supplement your income. Take a skill you have, no matter what, and get on Fiverr and start selling it.

You can usually sell it for significantly higher than you would if you had a job in the same field, mainly because it’s a short-term contract with a higher price.

The only downside is the fierce competition, but there is a way around it. Start giving away your service for free! This will help you get some reviews, word of mouth, and practice offering this service commercially.

Also, I don’t want to hear you have nothing to freelance. Everyone I talk to says this, but it isn’t true. At the most superficial level, take the most annoying part of your day job that no one wants to do and start freelancing.

Consulting

This one only works if you are an expert in a specific field where your advice is worth paying for. While it’s very hard to get there, it’s straightforward and happens organically for most.

First, you start with a full-time job where you trade your time for money and hopefully learn a valuable skill. Second, you begin freelancing that skill excellently, building a reputation and gaining more experience.

If you continue with step 2 long enough, people will eventually seek your advice; when it becomes consistent, you will know you can start charging for it.

This is most likely the highest form of generating income when trading your time for money.

Gig Economy

This is anything quick and short-term, usually done for money. It can be anything from delivering food to picking up tasks from TaskRabbit. While they aren’t always the highest paying, they are the most flexible.

This is best for someone working primarily on something else but needs something to earn money.

Sales

Most salespeople I know have a very low salary but make most of their money through commissioning. Most companies are happy to pay a big amount to a good salesperson since they directly justify their income by making the company money.

That means, in most cases, there are no limits to how much you can make. However, there is very high competition, with a low bar for entry, and your job security is often tied directly to your performance.

Teaching/Tutoring

This is my favorite side hustle —no questions asked. The reason is that there is an endless demand for good tutors, and honestly, there is not much of a supply. Pick whatever topic you were good at in school, and bam…you are a tutor.

When I started tutoring, I would go to schools and ask them if I could hang posters during parent-teacher conferences. The best part is, if you are good, as soon as you get one client, word spreads like wildfire.

Another thing that helped me a lot was the Facebook groups of moms and the marketing to moms on Pinterest.

Another trick is that you can tutor more than one kid at a time, multiplying your hourly rate by the number of kids you tutor. Instead of $30 for a one-on-one session, I would charge $20 and typically tutor three kids at a time.

Virtual Assistant

Virtual assistants help business owners or busy professionals with administrative tasks like managing schedules, reading and replying to emails, booking travel, etc.

VAs usually have flexibility since they manage their time and can work from home. That being said, they often find themselves managing many different clients at the same time, and it can be overwhelming.

Social Media Management

Social Media managers handle online presence and content for businesses and brands. The main goal here is usually to grow the brand’s reach as much as possible.

My only issue is that Social Media companies constantly change their rules and algorithms, which requires continuous learning, monitoring, and trend research.

Customer Service

Many companies look to outsource their customer service, mainly because it is cheaper and less of a headache.

I worked as a customer representative during college and hated it. It can be so draining. Honestly, all it takes is one lousy customer to ruin a day.

Construction Worker

Construction workers perform physically demanding jobs, such as building homes, plumbing, and concrete. However, these jobs are usually relatively safe since they require specialized skills to be successful.

I briefly worked in construction one summer and lost 12 pounds in 3 weeks. Construction workers make more money than the average person, but they earn it. My mom wouldn’t get near me before I got a chance to shower each night.

But to be honest, it was surprisingly fulfilling to do physical labor for 10 hours a day…call me crazy, but I can’t explain it either.

No Comment! Be the first one.