Have you ever wondered about the importance of an emergency fund? Here, I will cover the essentials of building and managing your emergency fund and how it can be vital in securing your financial well-being.

Managing your finances can be extremely stressful, especially when life throws a curve ball your way. An emergency fund helps remove some of that stress so you can focus on what is essential.

If you were anything like me when I started on this journey, you probably heard of and understood the general concept of an emergency fund but haven’t dug into what it means for you.

After taking a deep look into emergency funds, you will feel like a pro, ready to tackle whatever life throws at you.

This post is all about the importance of an emergency fund and how to get started and utilize it as your financial safety net.

What is an Emergency Fund?

An emergency fund is a portion of money you put away for life’s unpredictable moments. At FinanicalFreedomPursuit.com, I am all about budgeting and careful financial monitoring, yet the reality is that I often have plans that don’t always align with ours.

The importance of an emergency fund lies in the fact that, given enough time, something unexpected will happen with financial implications you didn’t plan for.

Yes, I just referenced the law of infinite probability – I do not apologize.

Why is an Emergency Fund Important?

An emergency fund acts as a critical buffer between you and a potential financial disaster in case of an unexpected event. While you may not know what life throws at you, having an emergency fund means you are prepared for whatever might come your way.

The term emergency is an umbrella that covers a broad range of scenarios. Consider this: What happens if your laptop suddenly needs replacing? or an urgent situation demands an emergency trip to care for a personal matter?

For a more realistic example, last month, my car broke down on the highway, and I was faced with possibly needing to replace the whole engine, costing approximately $7000. Not to mention the additional costs like the rental I would need for the three weeks it would take to fix it; something like that could have easily cost me $10,000. Can you cover that in an hour’s notice if needed?

Having an emergency fund means you don’t have to worry about all the what-if questions that come by default with life. It means you know that, within reason, you can withstand whatever comes up financially.

Now, full disclosure: for my care, I got lucky that a manufacturing defect played a role in my car stalling on the highway. Therefore, the dealership covered all my costs, including the needed rental. But if I didn’t get lucky not to have an emergency fund, I would have no way to deal with that situation besides taking in considerable debt.

How Much Should You Save in Your Emergency Fund?

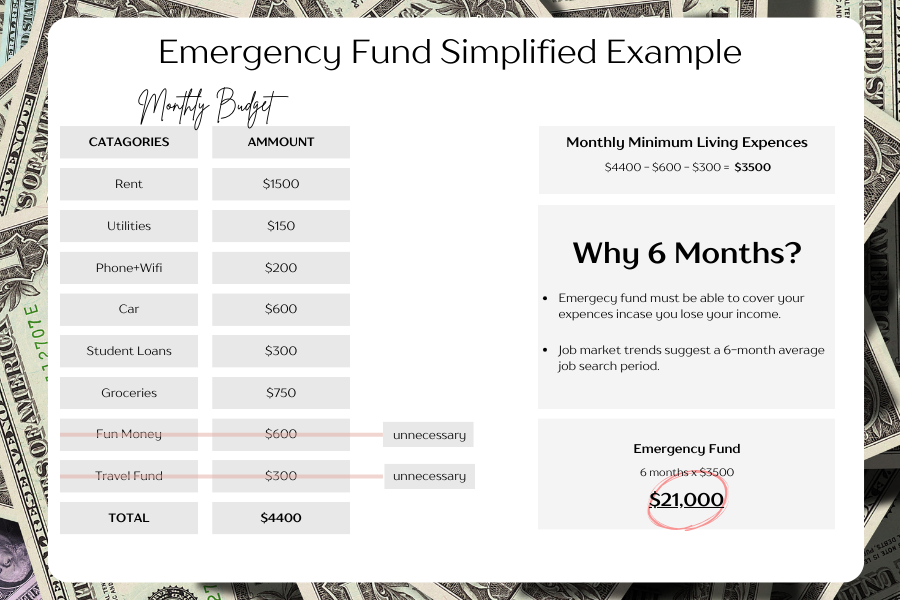

Everyone’s specific number is different because everyone’s living expenses are different. If you google it, the widespread consensus is “3-6 months of living expenses. While my recommendation falls in that range, I disagree entirely with the option for the range itself. Here is how I think of it.

Financially, one of the most devastating things that can happen is you lose your ability to bring money in. Given the unpredictability in today’s job market, I wouldn’t say that it’s unrealistic to think that can quickly happen to anyone. If you were to find yourself in that situation, according to TopResume.com, in 2024, it will take an average of 6 months to find a new job.

With that in mind, the minimum you need for an adequate emergency fund is six times your living expenses. That means looking at your budget and figuring out the realistic minimum amount it would take to live your life, taking out all the fluff. Multiply that by six to find your target amount.

Another thing to remember is that everyone’s risk tolerance is different. While I see six months of expenses as reasonable, that might not be sufficient for someone with a family. For someone with higher dependability, the long-term goal might be to beef up their fund to cover a year.

For Example

Steps to Building an Emergency Fund

Trust me, I get it. Building an emergency fund is a long and daunting journey, especially with the idea that the best-case scenario is that you never need it. But trust me, the peace of mind and protection it provides make it well worth the process.

- Assess Your Expenses: Start by deep diving into your budget and question every expense to identify and eliminate the non-essentials.

- Set Your Target: After subtracting all the unnecessary expenses from Step 1 from your living expenses. Multiply that number by 6 to get a target amount for your emergency fund.

- Create a Savings Plan: Decide the amount you plan to put aside for your emergency fund.

- Slow and Steady: Don’t be discouraged by the goal; save incrementally and consistently. Every dollar saved is a step closer to your safety net.

While that is a short list, that is all there is to it; the main thing is to get started. Without an emergency fund, your financial well-being is at risk, and it’s important to prioritize it with that in mind. I recommend pausing all other financial endeavors until you have that safety net.

Where to Keep Your Emergency Fund

Choosing the right home for your emergency fund involved balancing a few variables. Here is a breakdown of the essential qualities to look at when deciding.

- Liquid and Accessible: This means having the ability to transfer funds without delay, ensuring you can respond to financial emergencies promptly.

- Financially Insured: Protection is paramount. Look for a place where your funds are FDIC-insured, safeguarding your safety net.

- Guarded against inflation: Selecting a place that offers competitive interest rates can help mitigate inflation’s effects, preserving the purchasing power of your fund.

- Separate but integrated: Your emergency fund should be separate from your regular accounts, unaffected by the remainder of your finances. However, it should also be integrated enough to transfer funds without unnecessary hurdles.

Considering these qualities, a high-yield savings account is the most robust option for many individuals getting started.

- With higher interest rates, your fund is better guarded from inflation than a simple savings account.

- Many high-yield savings accounts are available through online banks.

- Ensure the account you go with is FDIC insured – meaning that your fund is protected up to $250,000.

While there are other options, such as money market certificates, I prefer the increased accessibility of a savings account.

Managing and Growing Your Emergency Fund

There are several factors to think about when it comes to managing and growing your emergency fund.

Regular Review: Your life isn’t static. Therefore, your finances shouldn’t be either, especially your emergency fund. Review your finances regularly and adjust your emergency fund amount as needed. For instance, if you just signed a lease to a more prominent place that charges an extra $300 a month, your fund target should increase by $1800.

Replenishment: While I hope you are never faced with any emergencies, more likely than not, something that doesn’t involve losing your job will come up. Make sure to prioritize replenishing your fund when you dip into it for such events.

Incremental Growth: As you progress in life and have more variables depending on you, such as a family or mortgage, consider incrementally growing your emergency fund. This means adding extra cushioning to account for more significant responsibilities you may acquire over time.

Common Challenges and How to Overcome Them

Trying to build up an emergency fund can be an extremely challenging process. Here are some common challenges and strategies to overcome them.

Starting the fund: The first step can often be the hardest. Start with a small and manageable account; even saving change from purchases or a small percentage of your income can set a foundation for your safety net.

Feeling overwhelmed: If the target amount feels too much, break it down into smaller, short-term goals. Make sure to celebrate each milestone, like I did, to stay motivated.

Staying Consistent: Consistency is vital; automate your savings to make the process as effortless as possible.

Dealing with Debt: It can be tempting to focus solely on repaying debt for those carrying debt. However, having at least a small emergency fund that even accounts for the minimum payment on those debts is crucial. This will also help you avoid being in a position to borrow more money in case of unexpected expenses.

Remember, the journey to financial security is a marathon, not a sprint. Trust me, the peace of mind with a well-managed emergency fund is well worth the commitment.

No Comment! Be the first one.