Want to know the essential personal finance basics for beginners to master your finances? You are in the right place. Understanding these basics can be a game-changer for anyone starting their financial journey.

Understanding your finances is a pivotal step toward adult responsibility and the freedom of financial independence. If you are anything like me and realize the importance of this, you are doing all the research possible to get the best understanding of personal finance.

A reason I started FinancialFreedomPursuit.com is that, unfortunately, that research confused me more as a beginner. I found it hard to get a straightforward answer on anything financial online without being sold a course on how to do it best.

My Goal is to cut the noise and offer straightforward, practical advice on the basics I found on my journey seeking financial freedom. You will learn about all the personal finance basics for beginners, from budgeting, emergency funds and debt, saving, credit, assets, and insuring those assets.

After learning all about the basics of personal finance for beginners, you will have a better grasp on applying them with confidence and your finances in general.

This post is all about the essential personal finance basics for beginners to help you take a step closer to financial freedom.

Embrace Budgeting – Your Blueprint

Embracing the habit of budgeting isn’t just a financial task—it’s a crucial step towards becoming financially independent. Budgeting won’t only help you manage your money, but it will also help you get a complete picture of your current financial situation. Helping you gain clarity and control over shaping your financial future with confidence.

Budgeting has helped me manage my money better and keep me from overspending while simultaneously acting as a path toward my short-term and long-term financial goals. From being better prepared in case of emergencies to planning my retirement, budgeting is a pivotal blueprint that has helped me get closer to my financial goals.

A Quick Step-by-Step Guide to Budgeting

Here is a quick summary of my seven budgeting steps; it’s a great place to start without feeling overwhelmed. If you want a more detailed and comprehensive guide, please review my “7 Simple Steps to Create a Budget: your 2024 Blueprint to Financial Freedom” blog post.

- Understanding Your Income: It begins with a thorough look at your income—not just your primary paycheck, but all the sources. It’s a bird’s eye on the landscape of your financial power, setting up everything for smooth sailing in money management.

- Expense tracking: Equally important is the diligent tracking of your expenses. This means both monthly and occasional expenses.

- Setting Financial Goals: Having specific financial goals is the destination of your budgeting journey. It can be anything from saving for a dream vacation to freeing yourself from debt. These goals make it easy to understand how to use your money best.

- Crafting of Your Budget: The next step after outlining your income and expenses and putting in place your goals is to craft a personalized budget.

- Reduce Spending when Possible: Reducing expenses will help you back up your choices and support your financial goals.

- Regular Reviews and Adjustments: Your financial conditions are not static, so neither should be your budget. Regular reviews and adjustments to match your evolving circumstances

- Staying Committed: Finally, the success of your budgeting journey rests on your commitment and motivation. It’s about establishing a habit of financial mindfulness.

A budget forms the foundation of financial literacy and independence. It’s a way of controlling your financial destiny and making informed decisions that push you closer to your goals. Embracing budgeting opens your life to a future where financial worries are limited and financial dreams can quickly materialize.

Establish an Emergency Fund – Your Safety Net

While budgeting is crucial to managing finances, the unpredictable nature of life means that it sometimes throws a curveball your way. An emergency fund acts as a financial safety net for various unexpected events—for example: medical emergencies, job losses, and significant car repairs.

In essence, having an emergency fund is about expecting the unexpected. It puts a safety buffer for you to fall back on during tough times.

How Much Should Your Emergency Fund Be?

There are so many opinions online on this topic; to be fair, it depends highly on your risk tolerance. Someone

For me, here are the two facts that dictate this for me.

- One of the worst things that can happen to you financially is that you lose your ability to bring money in to cover your expenses. Losing your job can be a devastating financial hit, significantly affecting your life.

- According to TopResume.com, it takes, on average, five to six months to find a new job.

Keeping these facts in mind, here is how you find the amount you should save for your fund. Look at your budget and find your barebone financial expenses total, the realistic bare minimum it would take to live comfortably each month. Multiply that number by six, and you have your magical number; it’s that simple.

If that number seems unrealistic, start small and gradually build up. Even a modest emergency fund can provide significant security as you build your full safety net.

Tackle Debt – The Road to Financial Freedom

It is no secret that debt in the US is a problem, but I don’t think everyone knows how much of an issue it is. According to Money.com’s research, the average personal debt an American has is a whopping $21,800. As of Feb. 14, 2024, the average personal loan interest rate is 11.91%, and the minimum payment is 1-4%.

Trust me; the math confuses me too. Using Bankrate’s calculator, assuming one is paying 4% (an astounding $872 /month) by the time they paid the loan back, they would have paid $3,380.67 in interest. If you think that is not good, wait. If that same average American only paid 1% ($218) a month towards that debt, that would be $86,202.91 in interest. With personal debt, there is only one winner – the bank.

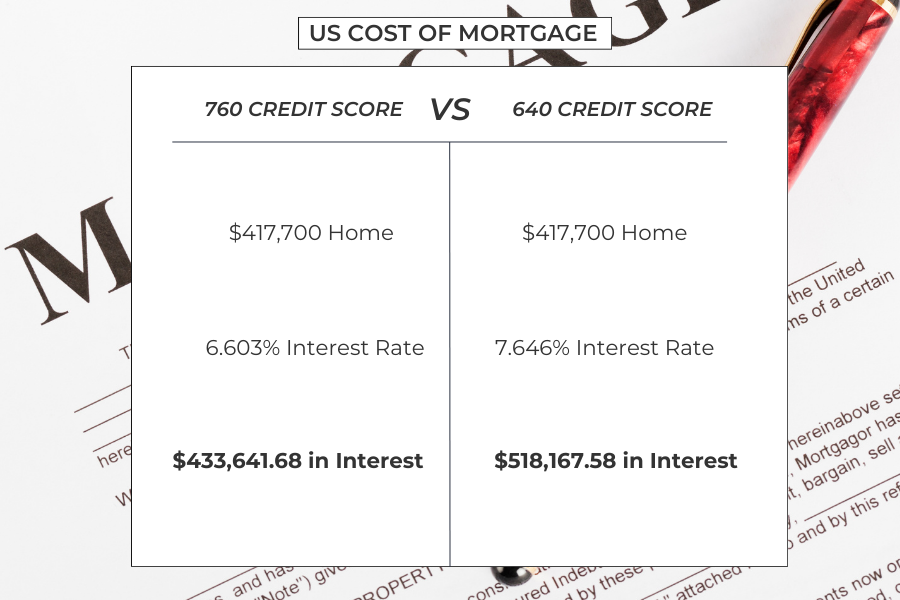

Not only that, but debt doesn’t just cost you in interest; it also hugely impacts your credit score, significantly affecting your finances. It’s unfortunate, but the reality in 2024 is that numerous necessities can quickly put you in a position where borrowing money is needed. From purchasing a car to a home, your credit score decides whether or not you can borrow money and the cost of borrowing that money.

The Method That Helped Me Pay Off My Debt

When I first started on this journey, I had some debt that was keeping me up at night. And while I don’t think of myself as an anxious person in general, that is the only word that appropriately explains how I feel. I threw everything I had in every month, but that was chaotic, and for the most part, I ended up where I started each month. I didn’t start making any progress in paying off my debt until I got organized.

Budgeting, by far, helped me the most; after accounting for all my expenses, I got a better idea of how much I could allocate towards paying off my debt. Also, the budgeting process helped me keep myself accountable for my goal of paying off my debt.

The more people I talk to, the more I realize the method you use isn’t what matters; it’s relentlessly sticking to a method that helps. While many swear by the snowball method, it didn’t work for me; my engineering brain couldn’t get on board. I used the avalanche method.

Snowball Method vs. Avalance Method

Snowball Method: This involves listing all your outstanding debts and focusing on the smallest debt first. This is done by paying the minimum payment on all the other accounts and putting as much money as possible into the most minor account. Once that account is cleared, you move to the second smallest, and so on.

The theory is that you use the momentum of paying off that small debt account to attach the next one, helping keep you motivated by seeing those accounts clear.

Avalanche Method: Using the same ferocity as the snowball method, instead focusing on the account with the highest interest rate, aka costing you the most. I side with this method because it saves you the most money.

When deciding between the methods, focus on whether you are more emotionally or logically driven. The most important thing is once you pick one, you stick to it.

Save for the Future – Beyond the Now

While establishing an emergency fund is all about building a financial safety net, saving for the future is about setting your finances up for long-term financial security and realizing those financial dreams. It’s about looking beyond the immediate horizon and planning for milestones like financial freedom, home buying, and retirement.

The importance here can’t be overstated; it isn’t just about accumulating wealth but creating the financial freedom to make choices that align with your values and goals. It involves discipline, planning, and prioritization, ensuring that you are both living for today and preparing for tomorrow.

How Much Should You Save?

While this varies immensely from person to person, depending on many factors like income, expenses, and goals, a common rule followed by many is the 50/30/20 rule. This means that 50% of your income goes towards needs, 30% towards wants, and 20% towards savings and investments. I aim for 50/20/30, but your ideal percentage depends solely on your financial situation and goal.

Here are some strategies I use to maximize my savings:

- Automate your savings: Set up automatic transfers from your checking account each paycheck. This will ensure that you consistently save or invest a certain amount without thinking about it.

- Company Employer Match: Use any employer offer to match your retirement savings amount. It’s essentially free money to help increase your savings.

By saving for your future, you create a foundation offering the security and freedom your future self will thank you for.

Understand and Use Credit Wisely – Your Leverage

In the world of personal finance, credit is a double-edged sword. Used wisely, it can be a powerful tool to help you leverage opportunities, from starting a business to purchasing a home. However, mismanaged credit can easily lead to financial pitfalls that are incredibly difficult to climb out of. While to do this justice, it needs an article of its own, let’s go through the basics of demystifying credit and explore how to use it to your advantage.

At the base level, credit is the trust you earn that enables you to borrow resources you promise to repay later. Your credit score quantifies this trust; lenders use that score to gauge the likelihood of you paying back a potentially borrowed amount. A good credit score opens the door to lower interest (cost of borrowing money) and better terms, making it crucial today.

Top 3 Things That Affect Your Credit Score

- Payment History: This is the most critical factor; the better your history of making payments on previous loans, the more likely you are to continue doing so. Therefore, lenders see lending you money as low risk.

- Amount Owed: The ratio of how much you borrowed vs how much you have available to borrow affects your credit score. This is calculated through a “credit utilization ratio”; for example, if you have a credit card with a limit of $10,000 but only use $2000 a month, that equates to a 20% credit utilization. Lenders use this ratio to gauge how well you are managing your current debt.

- Length of Credit History: Shows lenders how much experience you have managing debt and also adds validity to the first two things. For example, someone with a good payment history for ten years is at a lower risk than someone with a good payment history for one.

How To Build Your Credit

- Start: If you are new to credit, start by opening a credit account like a credit card or a small loan. This is where your credit history begins.

- Pay on Time, Every Time: The most impactful action you can take for your credit score is to pay your bills on time. Late payments significantly harm your credit and affect your score for seven years.

- Keep your Balance Low: Maintain a low balance on your credit cards, thus lowering the amount owed/credit utilization ratio.

- Regularly Check your Credit Report: Errors and mistakes can happen, things from fraudulent accounts to an incorrect date you make a payment. Checking your credit score allows you to catch and address these issues promptly.

Using Credit Wisely

To make sure credit works for you and not against you always keep these things in mind.

- Leverage Credit for Growth, Not Consumption: Use credit to make investments that will grow in value rather than for everyday consumption.

- Consider the Cost of Borrowing Money: Consider the interest rate and how long you will have to make payments; only use credit for purchases worth the cost of borrowing. Also, shop around and try to find the best terms you can.

Treat your credit cards as a tool for building credit and earning rewards, not a lifeline for living beyond your means.

Asset Accumulation – Building Your Foundation

In the long run, asset accumulation in personal finance is the foundation of your financial future. Asset Accumulation is about strategically building wealth that will serve you now and in the future. Whether your goal is financial independence, a comfortable retirement, or leaving a legacy, understanding asset accumulation is the first step toward those goals.

Why It’s Important

One word: Inflation. Inflation is the increase in the price of goods, usually around 3% a year. As time passes and products get more expensive, you can buy less with your money. Therefore, your money is worth less as prices increase.

Unlike passive savings, which lose value over time due to inflation, assets can grow, generate income, and increase your network. By focusing on asset accumulation, you aren’t just saving and investing in your future.

Where To Begin

- Set Clear Goals: Start with deciding what your end goal is. Is it retirement, financial freedom, education, or something else? A clear goal will help guide your asset accumulation strategy and motivate you.

- Educate Yourself: Ensure you are well-educated and informed regarding the basics of investment, real estate, and other assets that interest you. Knowledge is power, especially in finance.

- Create a Diversified Portfolio: Unfortunately, no investment is without risk, but diversification is critical to reducing risk. Diversification means spreading your investments across different asset classes.

Asset accumulation is not easy; it’s a long and challenging road. Market volatility, economic downturns, and personal financial crises can affect asset growth. However, you can navigate these challenges successfully with a well-thought-out plan, a diversified portfolio, and a long-term perspective.

No Comment! Be the first one.