Want to know the most straightforward steps to create a budget? This is a step-by-step breakdown to build a personalized budget that matches your financial situation.

Understanding and managing your financial situation is the first step toward financial freedom. The best tool for doing this is creating a firm and reliable budget. This process will give you insights into your current financial position and provide a roadmap toward your goals.

While creating a budget may seem simple initially, making one effective and consistent is far from easy. It’s important to understand that a budget is more than just numbers on a spreadsheet; it’s a roadmap that reflects your current financial situation and guides you toward your goals.

Here, I’ll share the straightforward steps I took to build a personalized budget that transformed my approach to money management. These steps helped me gain control of my finances. Before I learned these steps, my spending was erratic, significantly hindering my financial freedom goals.

This post is all about the steps to create a budget to help you take that first significant step toward financial control.

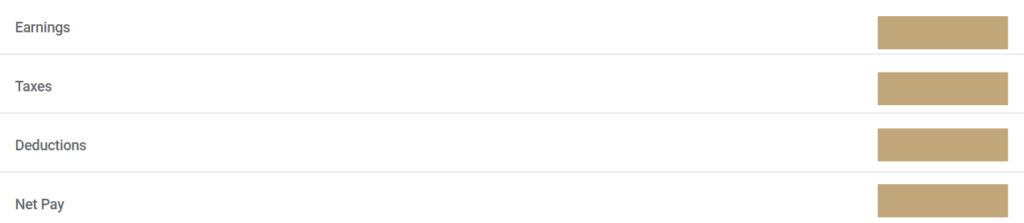

Step 1: Dive deep into your Income

This is the most crucial step; a complete and clear understanding of your Income is vital before diving into the nuances of budgeting. It’s not just about knowing your monthly salary. It’s about learning how your monthly salary might change and recognizing every stream that adds to your financial pool.

While this may differ from person to person, here is a quick list of things to go through when looking at your Income.

Identify and analyze all sources of Income.

I mean EVERYTHING. The number of people I talk to who think they only have one Income is astounding. Remember, the point of a budget is not to leave a single dollar unaccounted for; that is, for both money going in and coming out.

For example, how much are you getting back on credit card returns this year? According to Yahoo Finance, the average American spends approximately $1506 monthly on credit cards. If optimized for usage, that is a 5% cashback or $903 a year. And how about how much you are getting back in taxes this February? These “sources of income”can be used to offset some of your expenses and must be accounted for.

Actionable Tip: List every income source, including the occasional and irregular ones. You might be surprised by what you find and how it can bolster your budget.

Understand the frequency and stability of your Income.

Income isn’t just about the amount; it’s also about when and how consistently it comes in. Understanding whether you’re paid bi-weekly or monthly or have a fluctuating income from freelancing can help you plan more effectively.

For Instance: If you have a traditional w-2 job and get paid bi-weekly, as I do, you must account for things such as the “magical three paycheck months. Depending on your pay schedule, there will be two months where you get paid three times a month instead of two, either March and August or May and November. Most people do not account for this; they double their bi-weekly pay and only account for that as monthly Income.

Remember, the most critical point of a budget is that every dollar is accounted for; simply not accounting for those two months a year equates to not factoring in 8% of your Income in your budget.

Prepare for Variability and Plan Accordingly

Income can fluctuate due to job changes, market conditions, or global events. Recognizing potential variability allows you to adapt your budget, staying ahead of challenges.

For example, my net pay changed by four percent this January. When my wife and I dove into it, it turned out that there was an increase in my healthcare coverage due to inflation. That is a 4% change in Income just from a W-2 job, let alone side ventures and less predictable sources of Income that tend to fluctuate more dramatically.

Things like this can hit you out of nowhere. Understanding your Income fully will help you consider them and plan them accordingly. It is always better to be proactive vs reactive, especially with finances.

Adjusting my budget to account for inflation’s impact on healthcare costs taught me the importance of flexibility and foresight in financial planning.

Use your Income as a guide, not a set limit.

Living within our means is essential, but understanding your Income isn’t just about managing what you have; it’s about spotting opportunities to increase your earnings. This could mean negotiating a raise, exploring new side gigs, or investing in skills that open up higher-paying opportunities.

Analyzing my Income inspired me to invest in a professional course, leading to a role change and a salary increase. Your Income today is just the starting point for what you can achieve tomorrow.

Step 2: Categorize and Track Your Expenses

It’s a common pitfall only to consider last month’s expenses when planning your budget. However, this sets you up for surprises that might deplete your monthly savings margin. For instance, does your budget include annual car maintenance or mom’s birthday present next May? I would argue it’s more important to factor in the inconsistent parts of your spending than the ones you know are coming. Expect the unexpected!

The good news? Most of these expenses are predictable to some extent. Sites like RepairPal.com can help you with a ballpark estimate of your car’s expenses. And while you may not know precisely what you are getting your sister for her birthday, you know how much you spent last year.

Here is how to tackle it: I sit down and write all the categories I think I need to budget for, and then I do a long scroll of last year’s expenses. You will be surprised by the things you miss. Last year, the things that got me were $1200 for moving and $1000 for upgrading my iPhone X.

While this isn’t a complete list, here are eleven things to look out for

While this isn’t a complete list, here are 11 things to look out for

- Vehicle maintenance

- Annual Moving Costs

- Technology replacements and upgrades

- Subscriptions – precisely the total amount you spend a year on them.

- Birthdays and special events

- Clothing

- Travel expenses

- Personal development

- Office lunches.

- Outings – And their parking costs – oh, that sweet $40 parking downtown.

- Haircuts / Hygiene

Everyone’s situation is unique; someone living in their hometown might have a different traveling budget than one whose family is primarily overseas. The goal isn’t necessarily to cut back on these categories but to be aware of them and plan accordingly. That way, you are confident that your budget will meet all your short-term needs while advancing toward your long-term goals.

Step 3: Set Your Financial Goals

When I started budgeting, the amount and range of advice on how much I should spend or save drove me crazy. Everyone seemed to have a golden “rule” on what percent goes where, but they were all different. It turns out everyone’s rules are different because everyone’s financial goals are different.

Before creating a budget, an essential element to grasp is your budget’s constraints. This will help you answer questions like “How much can I spend on going out?” or “How many times a week can I get take out a week?”. The best way to answer those questions is to set your financial goals and work backward.

For example, if your goal is to be able to put a downpayment on a home in four years. With an average home cost of $417,700, a first-time home buyer aiming for a down payment of 6% needs to save $25,062 or $522 monthly over four years.

Similarly, my wife and I set our 2024 goal to max out our yearly contribution to our Roth IRA, which totals $500 monthly. We take our total monthly Income and subtract $500 to adjust our budget to accommodate this goal.

Here is how I would approach this:

- List your goals: List five financial goals, mixing short-term and long-term objectives.

- Work Backwards: Determine and subtract how much you must set aside or allocate monthly for each goal.

- Prioritize and Adjust: If your Income doesn’t cover all your goals, prioritize them based on personal importance.

- Review: Consistently review and adapt your list to match your evolving financial situation.

Setting these goals isn’t just about numbers; it’s about empowering yourself to build the life you envision. For me, each goal is a step towards financial freedom.

Step 4: Design Your Budget Plan

I can’t preach this enough: design your budget template. Most of the templates out there are either way too simple or over-engineered. It’s essential to make a budget that reflects your unique financial situation

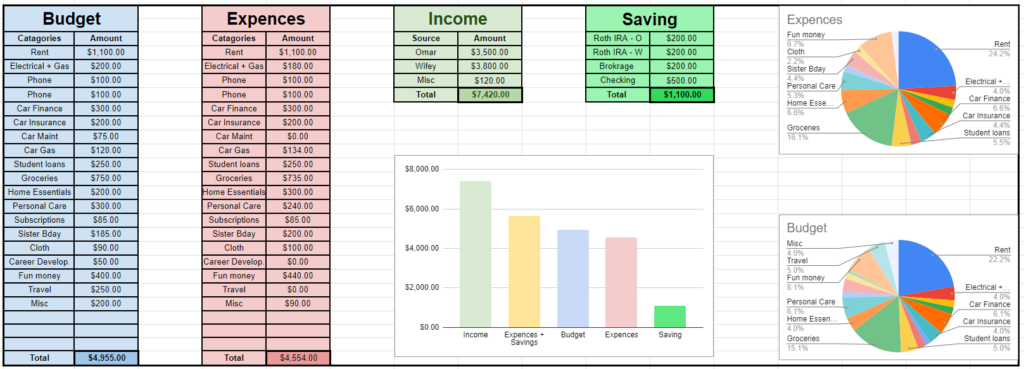

Keep it simple but detailed enough to track your actual spending against your goals. Start by listing your income sources, fixed and variable expenses, and quantifiable goals. I found that having goals in a separate table (in this case, savings) helps me visualize them as gone/nonnegotiable.

You can start with a basic spreadsheet listing these categories and then adjust it as you better understand your spending patterns and financial priorities. Include a section for irregular expenses, such as birthdays or annual subscriptions, to ensure these don’t catch you by surprise. For instance, in my March budget above, I have my sister’s birthday.

If you are interested in this template, contact me at thefinancialfreedompursuit@gmail.com. I would be more than happy to walk you through creating a similar budget for your finances.

Step 5: Implement Strategies to Reduce Spending

Sometimes, especially in the beginning, you will find a gap between your goals and budget. Whether you were hoping to save more or wanted to be able to afford more on a specific expense category, the easiest and fastest solution is to reduce your spending.

Like we want to study our Income to find growth opportunities, we also want to look at our expenses to look for minimizing opportunities. For instance, a friend paid for ESPN+ twice, once through this mobile carrier and the other through the service.

Unfortunately, it won’t always be that easy; that is why step 3 is so important. Having a prioritized list of goals will help you when it comes to making decisions regarding reducing spending. F

Step 6: Monitor and Adjust Your Budget Regularly

Monitoring and adjusting your budget is important to ensure that your budget matches your financial reality. That being said, if you did steps 1-6 correctly, this can be simple. Just make sure not to miss the details.

Have a budget review schedule.

Decide on a time each month to compare your actual spending against your budget. It’s not just about catching overspends but also understanding your financial habits and finding areas where you can or need to adjust.

I don’t recommend setting a strict specific time as that may be unrealistic depending on what is happening in life; instead, I set a deadline of the 3rd of each month. I always aim for the 1st, but I have a buffer to get to my review if something comes up.

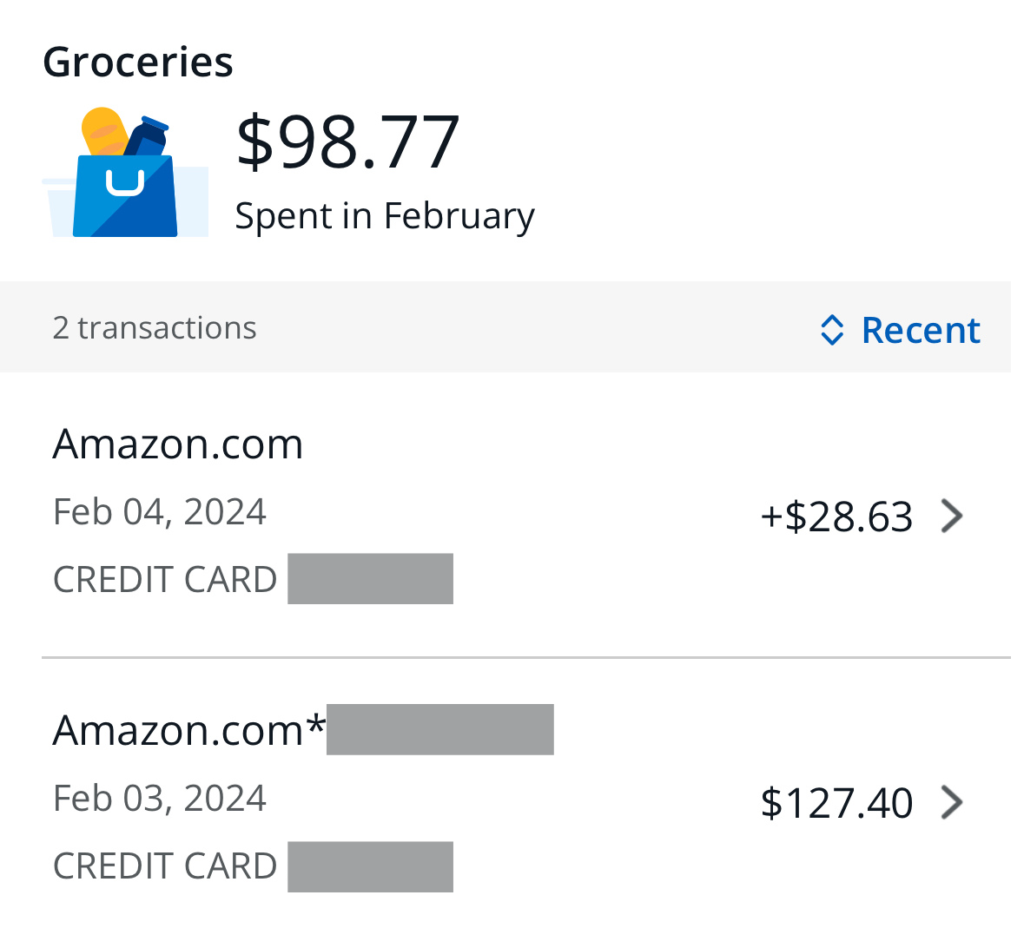

Utilize Technology – But don’t depend on it.

I use my bank’s budgeting extension to help me categorize my expenses and not get overwhelmed at the end of each month. That way, I can decide when to dive deeply into a category or do a simple check-in to ensure I stick to my budget.

One thing I found, though, is that the bank’s extensions aren’t always as accurate as I want them to be. For instance, I am unsure how an Amazon purchase for a $28 iPad Case counts as groceries instead of shopping. While these tools can be helpful, make sure to double-check, especially if something looks off.

Have a Miscellaneous Category

I use a “miscellaneous” category, usually with 2-3% of my income. This acts as a buffer for unexpected expenses or when I occasionally exceed my budget in a category. For example, if a friend visits unexpectedly, you can use this buffer for additional dining-out expenses without disrupting your overall budget.

You might now know what surprises life might throw you, but you can account for them.

Step 7: Stay Committed and Motivated

As much as I hope this has provided value to you, much of it is nothing new. The most important thing is staying on it and not letting it get out of hand.

Focus on maintaining momentum and staying committed to your budgeting practice, even during times when motivation wanes. I try to make everything as simple and accessible as possible. That way, even when I am not motivated, it’s easy. There is a reason I use a simple Google spreadsheet; it’s so easy to understand and check on the go.

No Comment! Be the first one.