Navigating the labyrinth of debt can feel like an unwinnable battle, yet I have discovered tried-and-true ways to get out of debt that have helped me transform my financial life.

While figuring out my debt, I have identified what works and what doesn’t – insights that will save you time and frustration. This will not be easy, but I hope these techniques and strategies will help inspire and guide you toward taking that critical step toward financial freedom.

In this post, I’ll outline seven fundamental strategies that will equip you with the knowledge and tools to tackle and finally eliminate your debt. My goal is that these insights accelerate your journey out of debt.

This post is about how to get out of debt to help you empower yourself to get out of debt faster.

Please Note: The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Understanding Your Debt

Understanding and fully comprehending the position your debt puts you in is essential to define the measures you need to take to eliminate it. In the world of credit cards and 1-click loans, it can’t be taken for granted that most people understand the impact debt has on their financial well-being.

“Debt is a thief, and it steals all that’s most valuable to you“

Ramsey Solutions

While I don’t always agree with Ramsey’s school of thought, he is undoubtedly correct, especially regarding bed debt. In the most direct way of thinking, taking on debt is the same as borrowing your future income, limiting your financial future. Not only that, but the process charges you an interest rate for the pleasure.

Types of Debt

So if you have noticed above, I mentioned “bad debt,” implying there are different types of debts, some good and some not. While there are countless ways to categorize debt like secured or unsecured and fixed or variable interest, the essential way, in my opinion, is “good debt” vs. “bad debt.”

An important thing to realize is that most debts can be either good or bad; it mainly depends on how you utilize it. Later, when I qualify some debt as good debt, I am not recommending (insert the standard ” I am not a financial expert disclaimer: I am not a financial expert) that you take on more good debt.

While this isn’t a complete list, let’s look at the most common types of loans and how I categorize them. I am not a financial expert; I am illustrating my thought process on how I categorized and, therefore, prioritized debt.

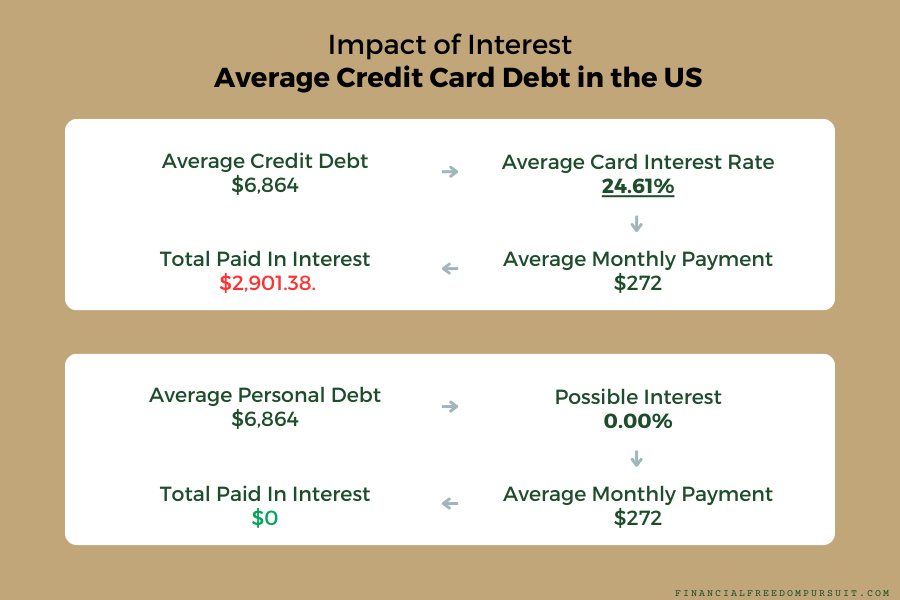

1. Credit Card Debt – Generally Bad Debt

Credit card debt is terrible unless used carefully and wisely for personal and defined benefit. This is mainly due to the high-interest rate that accrues with failure to pay the total amount on time. The higher the interest rate the worst the credit card debt.

If used responsibility and adhering to a strict budget for the specific benefits of the card it can be a tool to earn money back on some of your purchases.

2. Mortgages – Generally Good Debt

Debt accused from purchasing a home, assuming it is one you can afford, can be a valuable tool to increase your net worth. The critical factor is choosing a property wisely by consulting experts to ensure your investment is worthwhile.

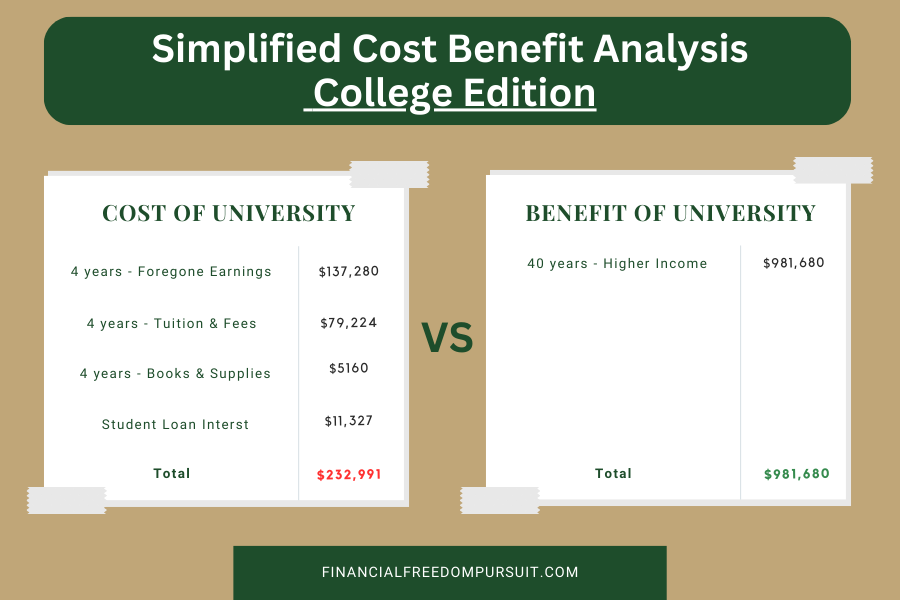

3. Student Loans – Can Be Good Or Bad Debt

Student loans are loans you take out to invest in your education. Like any other investment, it is critical to do a cost-benefit analysis. In this case, your ROI is your increased earning potential vs the cost of attending college, don’t forget to include your forgone earnings as a cost to attending college.

The simplified version above gives you a general idea, remember you need to look at the cost and benefit for any investment/credit taken for YOU. The school, the major’s employment rate, and the location significantly affect this.

Here is a calculator by GIGA calculator to help you with the initial math specifically for student loans.

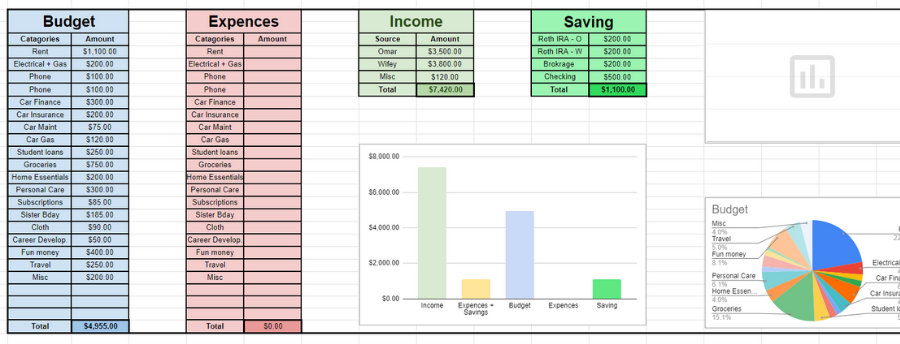

Crafting A Personalized Budget

Budgeting isn’t just a financial task – it’s a crucial step towards tackling your debt. Budgeting won’t only help you manage your money, but it will also help you get a complete picture of your current financial situation. This will help you know how and where to allocate your financial resources to better manage and free yourself from debt.

Here is a quick guide on how to budget, if you want a detailed step by step guide feel free to check out my article about it, linked below this section.

Quick Guide: Creating a Budget

- Dive Deep into Your Income: Understand all your income sources, not just your primary salary. Account for irregular income like tax returns or credit card cash back.

- Categorize and Track Your Expenses: Go beyond typical monthly expenses to include annual or irregular expenses such as vehicle maintenance and technology upgrades.

- Set Your Financial Goals: Define both short-term and long-term financial objectives. In this case, you are getting out of debt.

- Design Your Budget Plan: Create a personalized budget template that reflects your unique financial situation.

- Implement Strategies to Reduce Spending: Identify areas where you can cut expenses to align your spending with your financial goals better.

- Monitor and Adjust Your Budget Regularly: Set a regular schedule to review your budget, comparing actual spending against planned spending.

- Stay Committed and Motivated: Keep focused on your budgeting practice, maintaining momentum even when motivation is low.

Log your expences, eliminate any unnecessary expences, put the remaining towards your debt, and repeat. It doesn’t sound pleasant because its not, but trust me the relief after you have paid off your debt is worth it a million times over.

Increase Your Income

If you followed everything up to this point, you have categorized your types of debt and have your current finances organized and fine-tuned to lower your debt to the best of your current situation. The next step, and the most effective one, is increasing your income.

The concept is straightforward: the more money you earn, the more you can pay off your loans. Most people struggle to realize how simple, not easy, increasing your income can be.

Ways to Increase Your Income

- Change Jobs: The average American earns an extra 14.8% each time they switch jobs; this equates to an additional $8788.82 on average.

- Part-time Job/ Gig Work: While the impact of this depends on the hours you commit, even an extra few hundred dollars a month can be a game changer.

- Overtime: I like this more than part-time work since you can work longer at the exact location to earn more and potentially further your career. Unfortunately, not all employers offer overtime pay.

- Sell Unused Items: Online platforms make it easy to reach buyers to sell items you no longer use or need. This one-time income increase can provide a lump sum to pay down some debt immediately.

While there are other ways, like starting a business or freelancing, that can potentially be more lucrative, they take time to build up and aren’t as straightforward. The ways above are actionable straight forward steps to immediately increase your income.

PS: The ways that helped me personally were a mix of overtime and changing jobs. While my previous company didn’t offer overtime pay I worked tirelessly and was able to pick up the skills to transition to a higher paying position.

Choose a Repayment Strategy

Paying off debt might seem as straightforward as putting a portion of your income towards your loan balances. However, the strategy you use and how you implement it can significantly impact your journey. There are two main approaches to paying off your debt.

Both methods recommend you always make your monthly minimum payment on all your loans, as not doing so can severely impact your credit score.

Snowball Strategy

In this method, you focus on paying off your smallest debt first, then using that money you used to allocate to attach your next smallest debt, and so on. The idea is to “snowball” your payments as you go towards your most significant debt.

This also helps keep you motivated because you see accounts of debt close, and you use that momentum to keep going.

Debt Avalance Strategy

This method has you focuse on paying off the highest rate debt first and move down based on highest to lowest interest rate account.

The idea is that the higher the interest rate on an account, the more you pay in interest; therefore, focusing on those accounts first saves you money you would spend on interest otherwise.

Personally, the engineer in me couldn’t refute the avalanche strategy’s logic. Talking to friends who were in a similar situation I was, it seems like the most important thing is to pick the method that matches your personality and stick to it no matter what.

Explore Consolidation and Refinancing

Let’s start by defining each one.

Consolidation is the process of taking out a new loan to pay off your existing debt.

Refinancing is the process of transferring your debt to another card/bank with a different interest rate.

The main idea is to use one of these strategies to get a lower interest rate, lowering your monthly debt accumulation and overall debt. Below I will tell you how to do this and the effect it can have.

The diagram above doesn’t show that you would also pay off your credit card loan ten months sooner in this scenario. Use this calculator from calculator.net to see the effect this could have on your loans.

How to get 0% interest on your current credit card debt

- Find And Open The Right Card Account: Find a credit card with a 0% intro APR that allows balance transfer. Here is a list from nerdwallet.com

- Transfer Your Balances: Each bank is different; use your bank’s online app or call the bank to facilitate a balance transfer from your other accounts.

Wola, you are done. Your new card won’t charge you any interest from an introductory period and will save you money. While this isn’t a viable tactic for everyone, since credit score is a factor, this is the one strategy I regret not trying on my journey.

Utilizing Resources and Support

Full disclosure, I didn’t utilize this method. Unfortunately, I didn’t know about the several organizations and companies dedicated to helping with debt until after I managed to pay off mine.

These companies mainly have two services: debt management and debt relief.

Debt Management

Usually, this means you work with a debt counselor to evaluate your current financial position and devise a plan to eliminate your debt. Your credit counselor will also try to lower your payment by negotiating with your creditor.

According to investopedia.com, this will typically cost you anywhere from $0 to $35 initially and then a monthly fee from $0 to $75.

Debt Relief

If your debt is overwhelming, seeking help from a debt relief company may be your best bet. These companies contact your creditor to try to “settle” your account for less than the total amount; the average settlement is usually 48% of the balance owed.

According to bankrate.com, this can cost you up to 25% of the total debt settled.

One thing to note is that the creditor might not work with these agencies, and you carry colossal credit risk. This is because sometimes these companies will have you halt making payments to encourage your creditor to work with them.

Maintaining Motivation and Discipline

There is no way around it; this will be hard. The road to financial freedom is long, and sometimes it can feel like your progress is slow. Yet, maintaining motivation and discipline is the key to getting to the finish line.

Herre ate strategies to help you stay focused and motivated through out this journey.

- Set Clear and Achievable Goals: Break your big goals into smaller, more manageable milestones. Make sure to celebrate when you reach each one.

- Automate Your Payment: This will help you stay disciplined without making a conscious decision each time.

- Practice Self-Care: Maintaining mental and physical health is essential, so don’t neglect it. Aloow yourself small, budget-friendly rewards for reaching milestone.

- Keep Your Eye on the Prize: Remind yourself of the reason you are working so hard. Whatever it is, keeping your ultimate goal in mind can help you stay disciplined.

Maintaining motivation and discipline will be challenging but far from impossible. I hope that these steps can help you navigate your way through the road of financial freedom.

No Comment! Be the first one.